You want to be matched with the right life insurance provider. We want that too. That’s why we focus on finding you the perfect policy that protects you and your family. Our access to mainstream and independent insurers means that we can find the right policy for you.

FREE expert help & advice 0800 083 2829

Contact our specialist team for FREE expert help & advice 0800 083 2829

- Life Insurance

By Policy

- Critical Illness Cover

- Income Protection

Helpful Information

Do I Need Income Protection Insurance?

Income protection insurance is a policy designed to replace your income if...

What Are the Most Dangerous Occupations?

Some jobs naturally carry more risk than others, placing certain workers in...

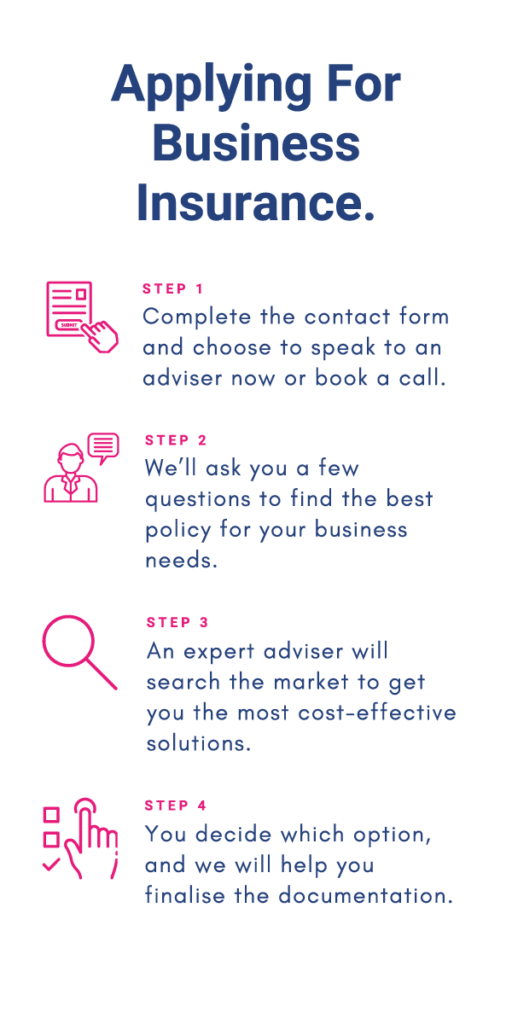

- Business Insurance

Life and Health Insurance for Business

Specialised Business Insurance

Helpful Information

Do I Need Business Insurance?

As a business owner or manager, protecting your company against unexpected risks...

How much key person insurance do I need?

Different businesses have different needs, so there’s no such thing as a...

- Private Medical Insurance